With that stated, you need to start analyzing your insurance coverage options when you have your permit so that you'll be ready to go when you get your license. Picking a Policy When it concerns picking a cars and truck insurance option that works for you, begin by calling your parents' insurance coverage representative to discover out how much it would cost to be added to their policy.

Many insurers offer multi-car discount rates. You can likewise acquire your own policy, however this can be rather costly. Make sure to go shopping around for the best option.

The Only Guide for Car Insurance - Get An Auto Insurance Quote - Allstate

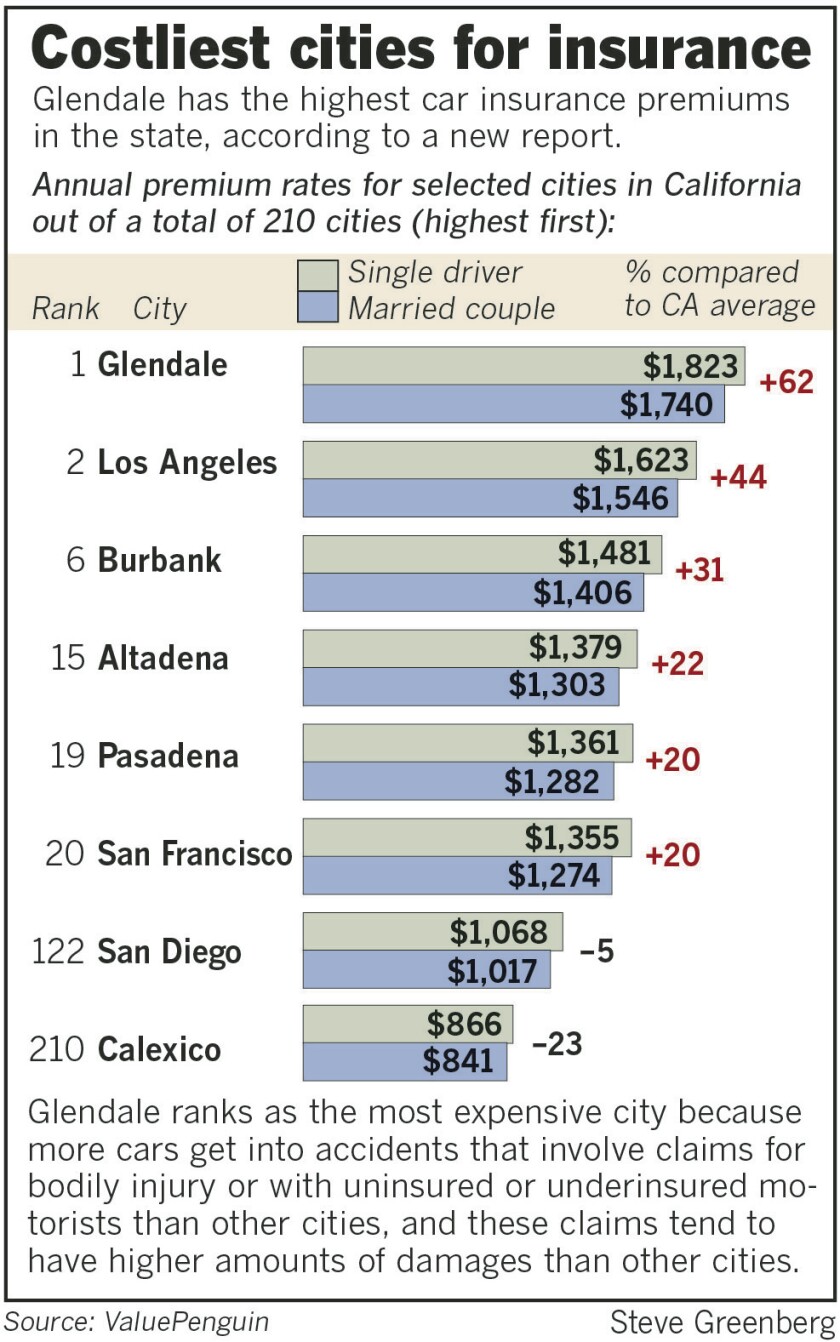

Chauffeurs who transfer to California from other states are in some cases amazed at the cost of automobile insurance coverage in California, and with good factor. California is among the more costly states in the country as far as the cost of cars and truck insurance goes, and even within the state rates can change significantly.

As you can see, your annual California vehicle insurance cost if you live in Mount Shasta will be quite various than if you live in Tarzana or Beverly Hills. The average annual premium based on this chart's data puts the expense of a yearly car insurance premium in California to around $2,058 each year.

The Single Strategy To Use For How Much Does Car Insurance Cost In My Area Of California

What affects California car insurance coverage rates? Lots of factors affect vehicle insurance rates, however if there's one factor that bypasses all others in identifying rates for drivers in California, it's the large number of chauffeurs in the state. Population numbers do impact automobile insurance rates; where there are more people and more cars, there are bound to be more accidents.

There are many reasons that people select to utilize their own vehicles rather than mass transit, including benefit and whether public transport can effectively get them to their final destinations. With a state as geographically large as California is, your choices to get from one location to another using public transport are limited.

Indicators on Ferrari California Car Insurance Costs You Need To Know

Similar to the population element, this indicates more vehicles on the roadway, and more automobiles usually suggests more mishaps. California is likewise a costly state in which to live, which increases cars and truck insurance costs in an intriguing way. Given that the expense of living is high in California, especially housing expenses, people try to conserve money any place they can.

In California, others do not purchase any automobile insurance at all. California's cars and truck insurance premiums are higher than those found in many other states, there are still methods to discover cheaper rates on cars and truck insurance.

The smart Trick of California Car Insurance - Geico That Nobody is Discussing

This increases earnings and decreases the possibility that clients will hop over to another provider if there's a price boost. To make the purchase of multiple "lines" more appealing, insurers will lower rates on policies. The more policies that you have with a single insurance provider, the more that you can conserve.

: Yes, this one will only offer savings with time, however it is essential. Pay your premiums on time and in complete, and be a consistently excellent chauffeur in California.: Increasing your deductible, the part of payment after a mishap that you are accountable for paying, can reduce your premium amount.

What Does Average Car Insurance Costs In California - Smartfinancial Mean?

Be honest with yourself, and choose a deductible quantity that is logical and realistic. Selecting a really high deductible in order to get a low insurance coverage premium rate might end up being a problem if you are in an accident and can not pay for to pay your deductible to get your cars and truck repaired.

, which can be a sensible and low-cost choice for those serving. As you browse for cheap vehicle insurance rates in California, keep in mind that the best insurance coverage in California is insurance coverage that supplies sufficient protection, and protection that you are delighted with.

The 45-Second Trick For Farmers Insurance: Insurance Quotes For Home, Auto, & Life

/GettyImages-1004420614-d368080d9b9742c2a9b97753639288ec.jpg)

For that sort of information, take an appearance at how other customers rate their insurance providers on our website. Save Cash by Comparing Insurance Quotes Compare Free Insurance Quotes Instantly Protected with SHA-256 Encryption The material on this website is used just as a public service to the web community and does not make up solicitation or arrangement of legal suggestions.

You must constantly seek advice from a suitably qualified lawyer relating to any particular legal problem or matter. The comments and viewpoints revealed on this website are of the private author and may not show the opinions of the insurance coverage business or any specific attorney. Freelance Author Jen Phillips is a self-employed author at Clearsurance.

How Much Does Car Insurance Cost By State? - Progressive Fundamentals Explained

Driving a vehicle means having car insurance coverage, because in California it's a requirement. California does not play games when it pertains to driving and remaining insured. There are dozens of auto insurance companies offering lots of various choices that fulfill or go beyond the state requirements considering that there are millions of drivers to guarantee.

Typical Cost for Minimum Vehicle Insurance Coverage Requirements in California, California, like practically all other states, has produced state laws that mandate automobile owners must have a certain level of auto insurance coverage. If you're driving in California, you are lawfully needed to have insurance and the policy info need to be in the vehicle with you.

Some Known Facts About Car Insurance - Get An Auto Insurance Quote - Allstate.

Value, Penguin has the highest annual average of $617 for minimum protection. Provided that information, it's safe to say vehicle insurance will cost around $550 a year or more if you decide for additional coverage.

Typical California Vehicle Insurance Costs Beyond the Minimum, If you live in California you won't be too shocked to discover that the yearly cost of car insurance is 20% greater usually compared to other states. That's thinking about all 27 million California chauffeurs, numerous of which pick to get car insurance protection beyond the minimum necessary quantities.

Average Cost Of Car Insurance In California For 2021 - Bankrate Fundamentals Explained

55. The Zebra approximates the average annual premium for California vehicle insurance coverage is $1,713 a year. There's a wide spread in between the averages for good factor. A great deal of elements go into the expense of a car insurance coverage premium. Companies are considering your age, marital relationship status, place and driving record before they give you a quote.

Overall, where you live in California can be one of the most significant determining aspects for the price of your premium. Some cities will have you paying lower than the national average, while others will be exorbitantly higher based on what it resembles driving in the city. In California, it is really prohibited for vehicle insurance coverage providers to take into consideration your credit report when identifying your rate.

7 Easy Facts About Covered California™ - The Official Site Of California's Health ... Shown

With such a vast quantity of choices for automobile insurance provider, it is necessary to compare coverage and rates prior to choosing which one you wish to go with. Examine out this useful guide on everything you require to learn about car insurance coverage in California, consisting of the types of discount rates used and the perfect insurance coverage companies based on your driving type.